The raw materials market continues to be under considerable strain. Market demand remains high and coupled with reduced supply, this continues to keep material prices at rates never previously seen across Europe and Globally. The conflict in Ukraine has added to an already difficult picture.

Key factors in keeping material price high:

- High demand for manufacturing, combined with reduced supply continues – there is no slack in the supply chain.

- Oil price is now at a 10 year high. It has doubled since January 2021 – Brent Crude Oil latest price chart

- Silica sand price has risen 15-20% which will affect the price of glass fibre.

- Energy prices continue to rise, which will impact on the cost of material production.

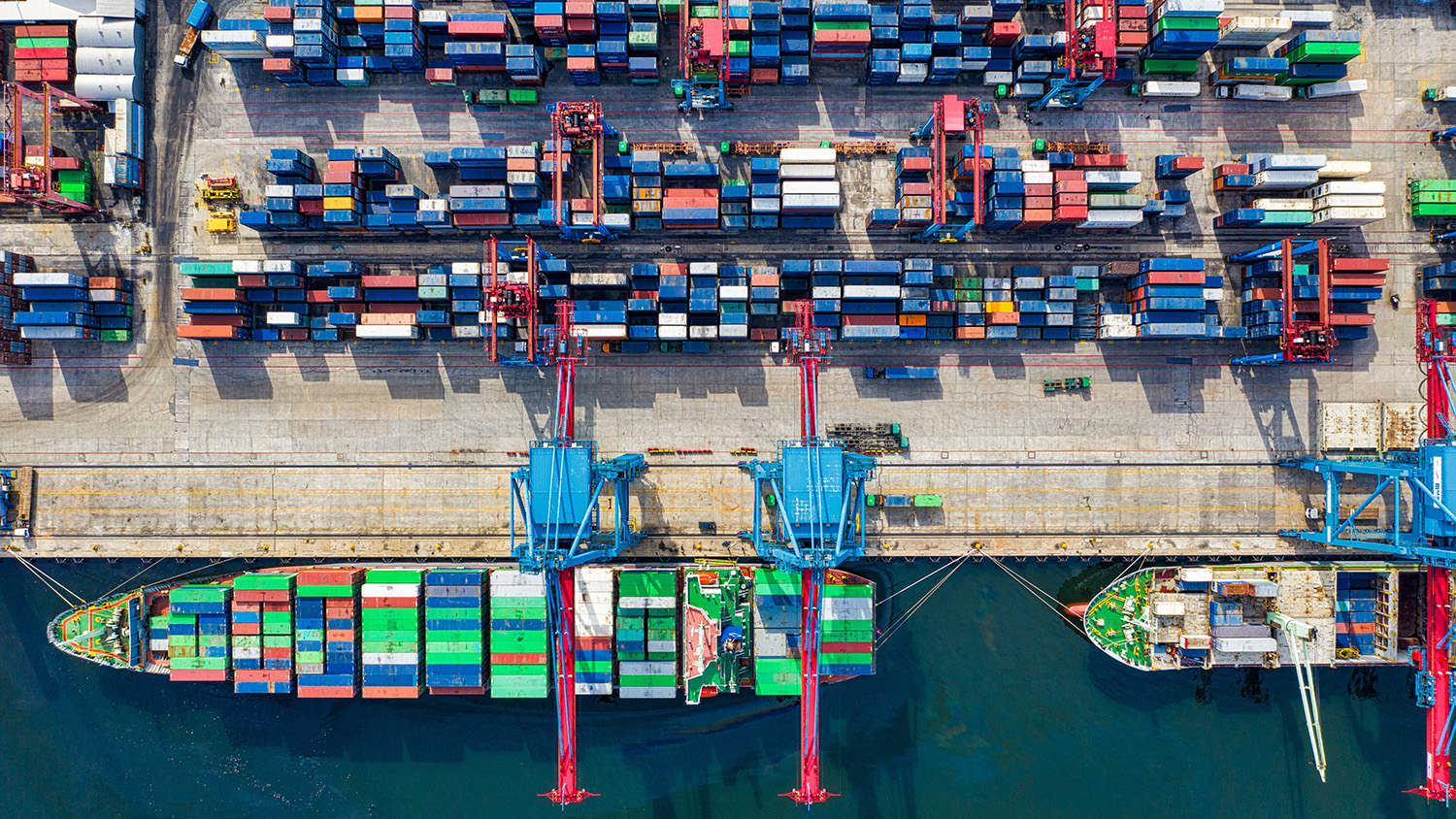

- There are still global shipping issues around delays and costs remain astronomically high.

- Shortage of logistics staff and HGV drivers, especially for the transport of hazardous goods, related to the high number of individuals forced to self-isolate due to Covid and the ongoing impact of EU-Exit in the UK. The conflict in Ukraine exacerbates this as drivers return to defend their country.

- Other industries are competing for the same limited supply of material.

The impact is across all resin systems and speciality chemicals, reinforcements, including glass and carbon fibre, organic peroxides, and many others.

It should be reinforced that raw material shortages and price increases are not limited to the composites sector.

These factors continue to influence key aspects of the composites industry, the timber industry, the aggregate industry, the plastics industry, and chemicals industry to name but a few.

- Engineering thermoplastic prices rose 28% in 2021

- Standard thermoplastics saw a 70% increase in price during 2021

- The price of concrete rebar is up almost 43% what it was 12 months ago.

- Steel prices hit record high in 2021 and are forecast to remain elevated through 2022

- Timber prices were 48% higher in Sept 2021 than the previous year

It is difficult to predict the long-term outcome, but reports suggest that raw material prices will remain high till at least early Q3 2022 and that the global shipping and transportation issues may not be resolved until 2023.

For more information on raw material prices for the composites sector:

- Tecnon Orbichem

- Independent Commodity Intelligence Services

- Composites UK member resources – Material Supply Information

- News articles covering the issue:

- Shortages 2022: 5 products expected to be in tight supply this year

- Supply chains in 2022: shortages will continue